-

What Does A Russian Invasion Of Ukraine Have To Do With The South Florida Real Estate Market?

MON JAN 31, 2022 BY OPPENHEIM LAW ON FLORIDA REAL ESTATE

Whether Russia invades Ukraine has not only tremendous political but also global financial consequences. The United States has already threatened sanctions targeting Russia’s ability to send money throughout the world. Perhaps the most far-reaching financial sanction would be to block folks in Russia the ability to use the internationally renowned and recognized Belgium based SWIFT system of payments that moves money among thousands of banks globally.

What is SWIFT and how can this potential sanction effect real estate?

SWIFT, or the Society for Worldwide Interbank Financial Telecommunication, founded in 1973, replaced telex and is now used to send secure messages and payment orders through financial institutions around the world. Removing Russia from the SWIFT system would make it nearly impossible for financial institutions to send money in or out of the country. In essence, the cut off would terminate all international transactions for Russians.

The Trump International Beach Resort in Sunny Isles Beach, FL. Picture courtesy booking.com

The Trump International Beach Resort in Sunny Isles Beach, FL. Picture courtesy booking.com

While the United States would need support from the participating countries who make up SWIFT, should this sanction proceed, this will have a huge impact on our real estate market. Specifically, investments in purchasing real estate in the United States, and closer to home in South Florida may come to a halt for those Russians who keep their money in Russia.

The South Florida housing market has had its share of international buyers, especially in the luxury market. In 2017, for example, Russians purchased $98 million in Trump’s Miami-area properties. South Florida foreign purchases accounted for 14% of total dollar volume and 13% of all South Florida residential properties sold in 2021, according to the Miami and National Association of Realtors. While these figures include other countries, Russia is a major player in terms of purchasing South Florida properties, especially in Miami-Dade.

What would happen if SWIFT sanctions curtail Russia from South Florida real estate?

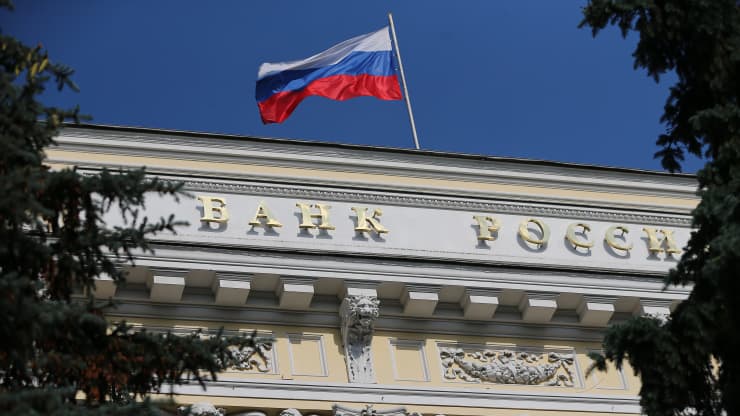

Russia’s central bank in Moscow. Picture courtesy Gavriil Grigorov | TASS | Getty Images

Russia’s central bank in Moscow. Picture courtesy Gavriil Grigorov | TASS | Getty Images

Russian investors may try to work around a potential SWIFT sanction by using cryptocurrency to invest in South Florida real estate. However, reports indicate that Russia has proposed bans on the use and mining of cryptocurrencies. Should the SWIFT sanction actually occur, whether Russian investors use the crypto market—or be able to use cryptocurrency to purchase South Florida real estate remains to be seen.

Many Russians over the years have already pulled their cash out of Russia and placed their cash in other countries for these exact reasons. While there may be limitations as to that amount or limit, those Russians would still have access to use those funds for foreign investment or real estate purchases.

What does this all mean?

It remains to be seen how the political landscape will evolve in the Russian/Ukrainian issue, and how the world stage will react. The proposed sanction of curtailing the global flow of money in and out of Russia through SWIFT would inevitably affect Russian investment within the United States, and in real estate in South Florida. Conceivably, Russian real estate investors in South Florida may need to sell if they face a liquidity crunch if they do not have access to their cash in Russia. On the other hand, less Russian buyers in the market may dampen the continual rise of South Florida real estate.

From The Trenches

Roy Oppenheim - ESQ.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.